willieredrick

About willieredrick

Understanding Personal Loans for Bad Credit and No Cosigner: Options, Challenges, And Solutions

In right now’s monetary panorama, personal loans have turn out to be a preferred possibility for individuals in search of fast access to funds. However, these with unhealthy credit typically face important challenges when trying to safe a loan, particularly and not using a cosigner. This article explores the intricacies of personal loans for bad credit and no cosigner, examining obtainable options, potential pitfalls, and strategies for improving one’s financial scenario.

The Panorama of Personal Loans

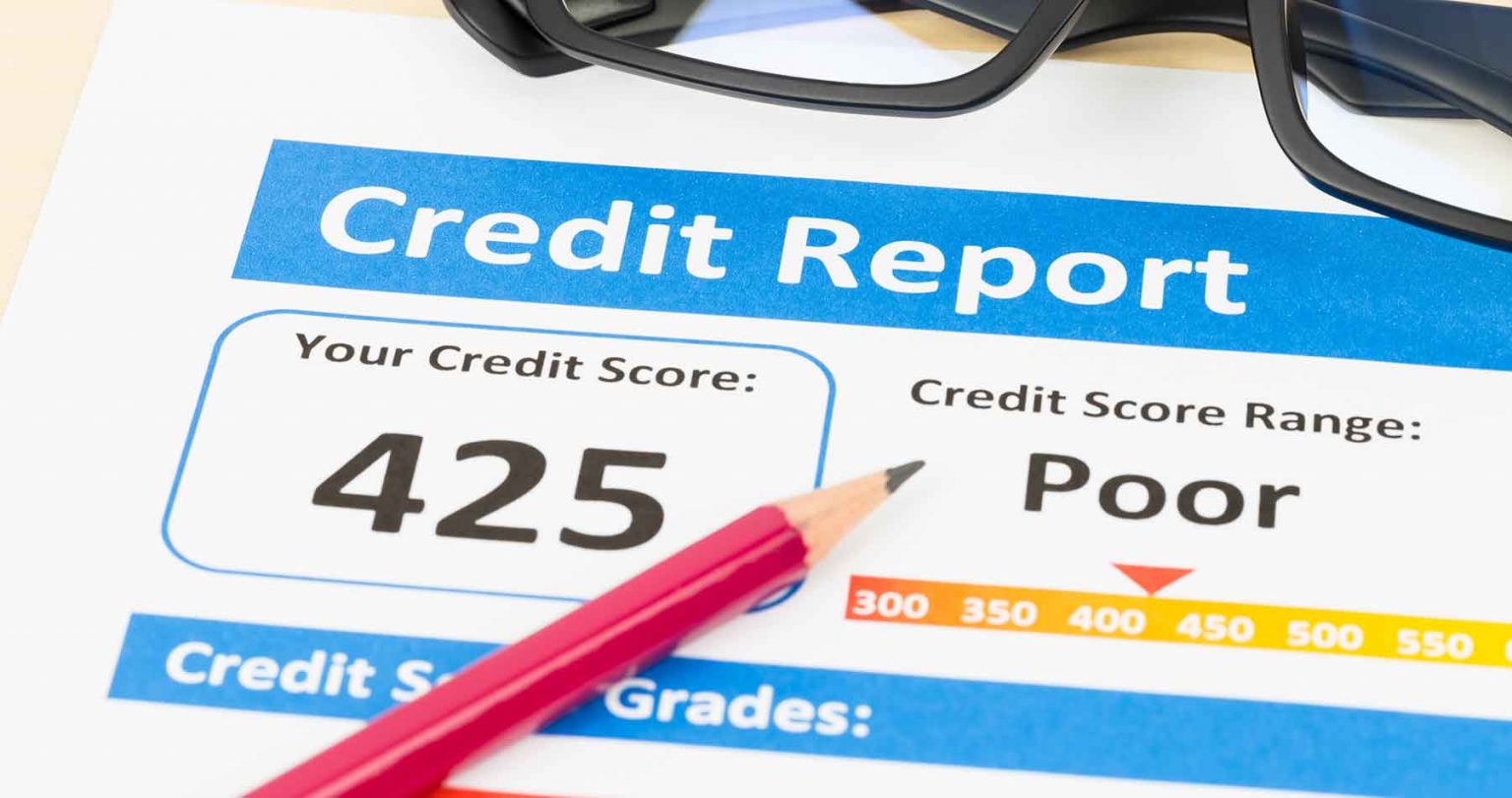

Personal loans are unsecured loans that can be utilized for varied purposes, together with debt consolidation, home improvements, medical bills, or unexpected emergencies. In contrast to secured loans, which require collateral, personal loans depend on the borrower’s creditworthiness and ability to repay. For people with dangerous credit—typically defined as a credit score rating below 580—obtaining a personal loan may be notably challenging. Lenders often view these borrowers as high-risk, resulting in larger interest rates, lower loan quantities, and stricter repayment terms.

Understanding Unhealthy Credit

Dangerous credit can result from varied elements, including missed funds, excessive credit score utilization, foreclosures, bankruptcies, and different financial missteps. Credit scores are calculated based on several standards, together with cost history, amounts owed, size of credit score historical past, new credit, and sorts of credit used. A poor credit score score can severely limit borrowing options and may additionally have an effect on employment opportunities and insurance coverage premiums.

The Role of a Cosigner

A cosigner is a person who agrees to take accountability for a loan if the first borrower defaults. Having a cosigner with good credit can significantly enhance the possibilities of loan approval and should result in more favorable loan phrases, resembling lower interest charges. Nonetheless, not everybody has access to a dependable cosigner, which could make securing a loan much more challenging for these with dangerous credit score.

Choices for Personal Loans with Unhealthy Credit and No Cosigner

- Credit Unions: Credit unions are member-owned monetary establishments that always supply more favorable phrases than conventional banks. Many credit unions have programs particularly designed for individuals with bad credit score, making them a viable option for those looking for personal loans with out a cosigner.

- Online Lenders: The rise of fintech corporations has expanded the lending panorama, with many online lenders catering to borrowers with poor credit score. These lenders often use various data to assess creditworthiness, which can consequence in additional lenient approval standards. Nevertheless, borrowers should be cautious and thoroughly analysis any lender to avoid predatory practices.

- Peer-to-Peer Lending: Peer-to-peer (P2P) lending platforms connect borrowers directly with individual investors prepared to fund loans. This model can provide access to funds for those with bad credit, as buyers may be more keen to take risks based on private stories and repayment plans.

- Secured Personal Loans: While not splendid, secured personal loans require collateral, such as a vehicle or savings account. This option could also be obtainable to individuals with unhealthy credit score, because the collateral reduces the lender’s danger. However, borrowers should be ready to lose their collateral if they fail to repay the loan.

- Specialized Lenders: Some lenders concentrate on offering loans to individuals with bad credit. These lenders may provide greater curiosity rates and less favorable phrases however could be a viable option for those in urgent need of funds.

Challenges and Risks

While there are choices accessible for obtaining personal loans with dangerous credit score and no cosigner, several challenges and dangers should be considered:

- High Interest Rates: Borrowers with bad credit score typically face exorbitantly excessive interest rates, which can lead to a cycle of debt if not managed properly. It’s crucial to calculate the full cost of the loan and make sure that it suits inside the borrower’s price range.

- Predatory Lending Practices: Some lenders goal individuals with bad credit score, providing loans with hidden fees, exorbitant interest charges, and unfavorable terms. Borrowers must be vigilant in studying the superb print and understanding the total cost of the loan.

- Influence on Credit score Rating: Applying for multiple loans can negatively affect a borrower’s credit score rating, as every utility may result in a hard inquiry. Borrowers ought to limit their purposes and give attention to lenders that are more likely to approve their loan requests.

- Restricted Loan Amounts: Lenders could prohibit the amount of cash available to borrowers with unhealthy credit score, which is probably not adequate for their wants. It is vital to evaluate one’s monetary situation and decide the precise amount required before applying for a loan.

Strategies for Improving Creditworthiness

For people with dangerous credit, taking steps to enhance creditworthiness can improve future borrowing choices. Listed here are some methods:

- Pay Payments on Time: Consistently paying bills on time is without doubt one of the most vital elements in improving credit score scores. Setting up computerized funds or reminders may help ensure well timed payments.

- Reduce Debt: Paying down present debts can decrease credit utilization ratios, which may positively affect credit scores. If you beloved this posting and you would like to acquire a lot more information pertaining to Fast Personal Loans Bad Credit Online kindly visit the web site. Concentrate on paying off excessive-curiosity debts first.

- Check Credit Reports: Frequently reviewing credit score studies for errors or inaccuracies will help establish areas for improvement. Borrowers can dispute any inaccuracies with credit bureaus to rectify their reviews.

- Consider Credit Counseling: Seeking assistance from a credit counseling service can provide beneficial insights and techniques for managing debt and bettering credit scores.

- Construct a Constructive Credit History: Consider using secured credit cards or small installment loans to determine a constructive fee historical past. Over time, this may help improve credit score scores.

Conclusion

Acquiring personal loans for bad credit and no cosigner could be difficult, but it is not not possible. By exploring varied options, understanding the dangers, and taking steps to improve creditworthiness, people can find options that meet their financial wants. It is crucial to strategy the borrowing process with warning, conduct thorough analysis, and make knowledgeable decisions to safe a loan that aligns with one’s monetary objectives. With diligence and perseverance, people with dangerous credit can navigate the lending landscape and work towards achieving monetary stability.

No listing found.